Nearly all the tax issues that the taxpayers usually have could be solved online or by the IRS Customer Service Phone Number. That is why, when you visit the official website of IRS, you can find all the important links for IRS Customer Support, including the tax payment option.

Internal Revenue Service is a Federal Agency of the United States. The Commissioner of Internal Revenue who controls the IRS is always appointed by the President of the United States, and currently, Charles P. Rettig is the commissioner. This government agency is a bureau of the Department of the Treasury, headquartered in Washington D.C.

Ways To Contact IRS Customer Service

Most often, plenty of questions are asked in the community page of IRS, the most common ones include –

- How to change the home address at IRS

- What is the age limit to claim the child as a dependent

- What is the minimum income to file an income tax return?

- If the payment plan is under installments, can I receive a tax refund?

IRS Customer Care Number

The first and most asked method to contact the customer service at IRS is calling the IRS Customer Service Number directly. This is because there are many who are not able to use online services because they do not know how to.

For the customer support, you can call on the helpline number – 1-800-829-4933

For questions about personal taxes, call – 800-829-1040

For businesses, the helpline number is – 800-829-4933

For Non-Profit Taxes – 877-829-5500

Calls regarding Estate and Gift Taxes – 866-699-4083

Customer support number for excise tax – 866-699-4096

You can even schedule a face to face appointment at the IRS local office to get help. First, you need to locate the nearest office location to you, and then call there to fix an appointment.

Find the office closest to you using the Taxpayer Office Locator, and then call 844-545-5640 to fix an appointment.

IRS Customer Service Hours

Almost all the customer support executives are available in between 7 AM to & PM daily (Local Time)

But for non-profit taxes, the calling hours are 8 AM to 5 PM

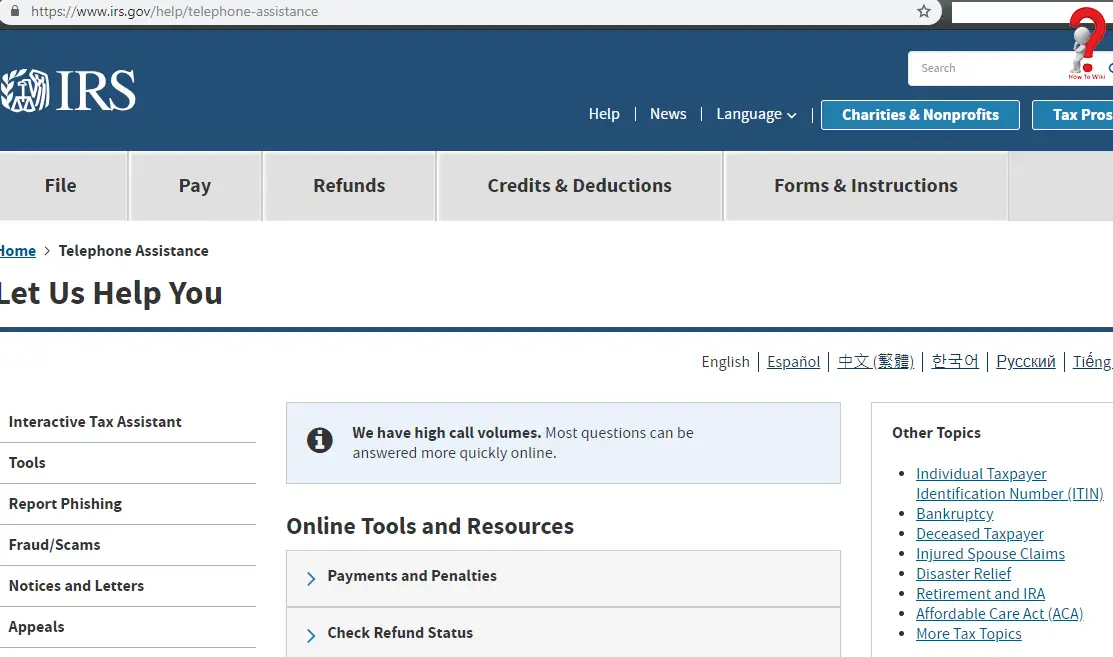

Visit the telephone assistance page for more information on how and when to call the customer support agents – Visit

IRS Customer Service Email

There is no direct email for the Internal Revenue Services, but for all kinds of issues or questions that taxpayers might have, they have all the options on their Official Website

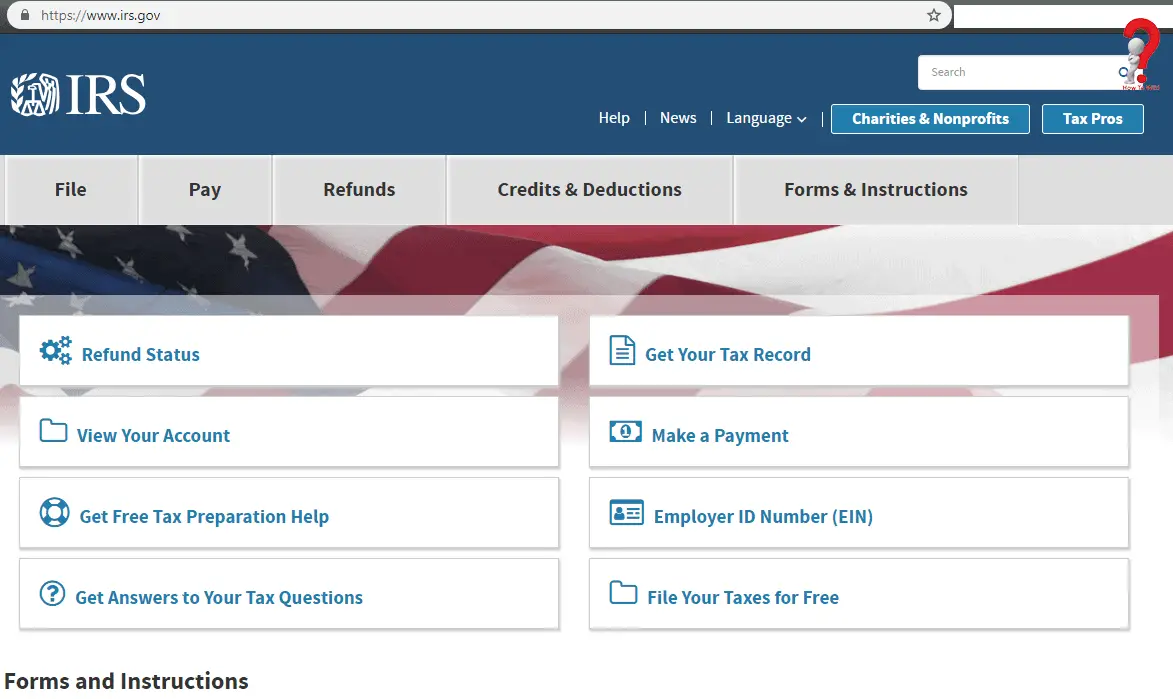

Here are some of the direct links which you can use to visit different pages IRS online

1) To pay your Taxes online – Visit the Payments Page

On this page, you have options to pay your taxes online without any hassle. You can pay directly with your bank account for free.

They have an option for the taxpayers who cannot pay the taxes at the moment. They can meet the tax obligation in monthly installments, and for that, you can find the payment plan. You need to find out if you qualify for this feature first.

2) To view your tax account – Visit the View Your Tax Account Page

This tool can be used to view your payoff account, balance for each tax year for which you owe, last two year of your payment history, information on your current tax return. This feature is for individuals only.

After you have successfully viewed the information, you can find the option to go directly to the payment page without having to log in again.

3) For a refund on your payment – Visit the Refunds Page

For this to work, you will need your social security number or ITIN, filing status, the exact refund amount.

IRS Customer Care

Other methods ~

To avoid the wait you have to do while calling the customer support, you can try some other ways that are available for support at IRS.

Firstly, you have the FAQs Page of IRS. Here customers’ common questions are put up with the most relevant answers. You can visit the page, and search for your issue.

Secondly, you can visit the social media accounts, where the social media managers are available in working hours to help you out with your problems.

Here are customer service helpline for other companies too

Contact Groupon Customer Support

Contact TMobile Customer Support

Contact DirecTV Customer Support

Contact FedEx Customer Support

Conclusion

Whether you visit the website for payment of your taxes, or to know details about your account, you can easily get all your answers. There are online portals, support options overcall, and the FAQs page to get the support. Choose what suits you the best, and if you still have problems, you can discuss them with us.