Payslip which is also known as the employee pay slip is the mandatory slip to be had by any such organization which is having the working employ base under it. Payslip is basically a slip which records the amount of remuneration or the salary, which is being paid by the company or any other organization to their employees for the services of the employees.

So, if you are having any kind of organization where the certain numbers of the employee work then you are also going to need this template. Here in this section of the article, we are going to provide you with the free payslip template, which you can use in your own organization to issue it to the employees.

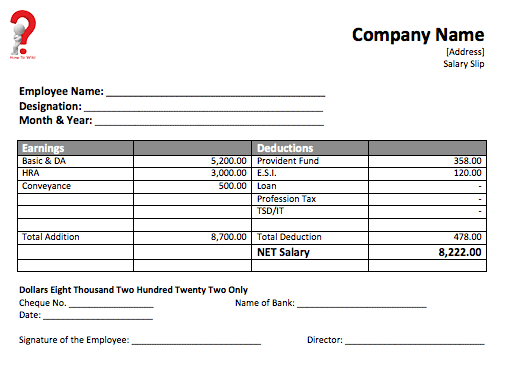

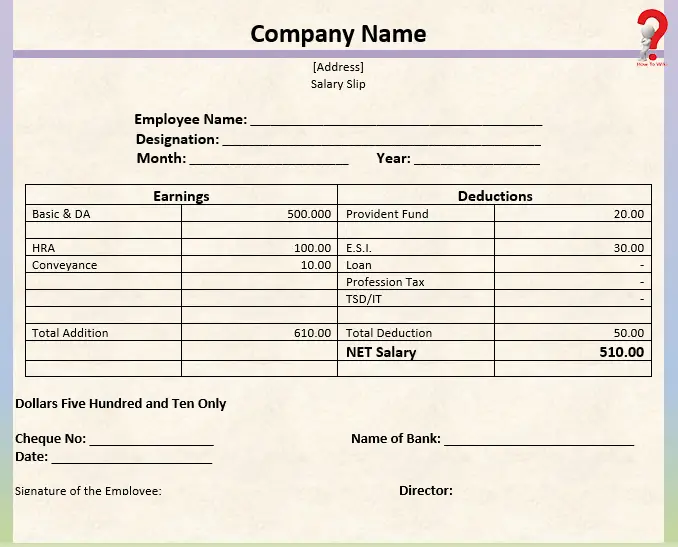

Free Blank Payslip Template

If you want to design or customize the payslip of your organization in your own way then getting the blank payslip would be the decent choice for you. This kind of payslip will provide you with the customization aspects so that you can only insert the desired employee payslip details in it.

Payslip Template Excel

The majority of the business and other government organizations use the Microsoft Excel software in their routine working as this is one of the best software which offers all kinds of official solutions.

If you get the payslip template in the same format then it would be easy for you to manage the payslip within the same software, and make the required changes into it. The template of the payslip has been designed with the fully professional standards and the outlook.

Payslip Template PDF

PDF basically stands for the portable documented file and this format is one of the simple yet the best format for the payslips.

We are saying it as the simple format since this format is compatible with all kinds of digital devices thus having the payslip in this PDF format will make sure, that you and your employees can access the payslip using the simple digital devices such as the smartphone etc.

Further, the payslip in the PDF format has less size in the comparison of the other formats.

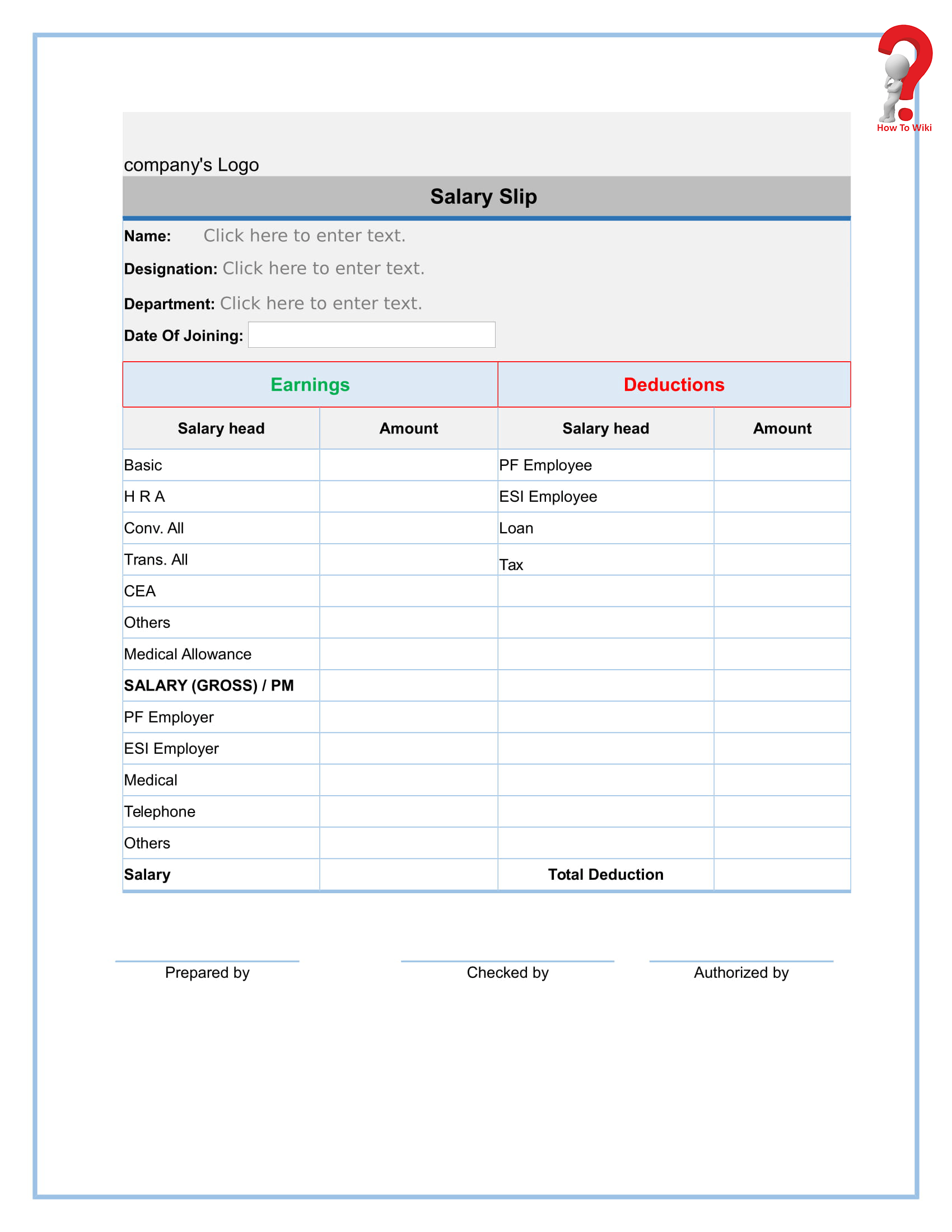

Payslip Word Template

Word is one of the best word processing software and creating official documents.

If you use the Word software in your routine working then getting the payslip in the same format is the wise option, as you won’t have to use the other software in order to access the template. We are attaching the Word format of the payslip template here for your concern.

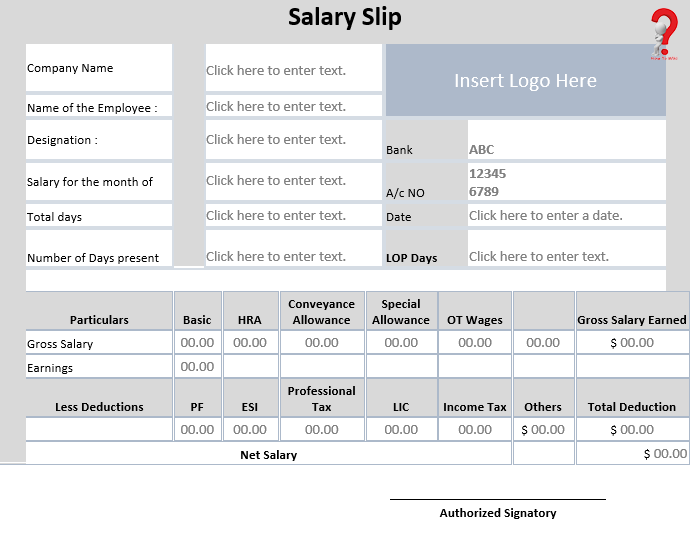

Download Free Simple Payslip Format

If you want one such payslip which should be easy to be understood both by the employee and the employer as well, then we are having the simple payslip for your concern.

This simple payslip avoids containing any kind of unnecessary and the complicated information in it. It just straightforwardly serves the required purpose of the payslip and you can get its template from here.

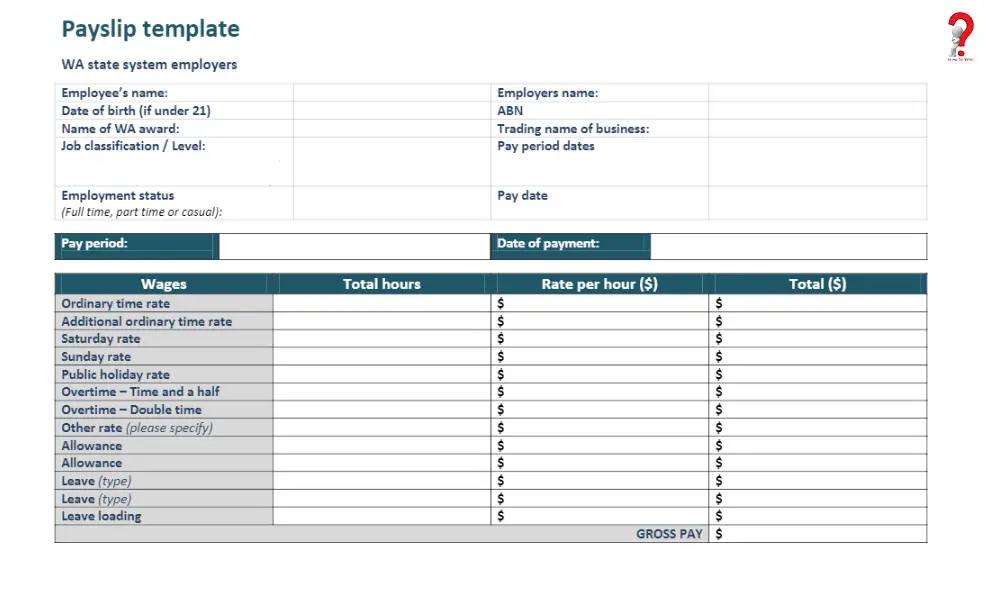

Payslip Template Australia

If you are having any kind of organization which is operating in Australia then also you are going to need the payslip in the context of your organization, since there must be the proof of salary distributed to the employees.

Here we are providing you the payslip template which has been designed keeping the norms of Australia into consideration, and thus it will be legally valid in the Australian region.

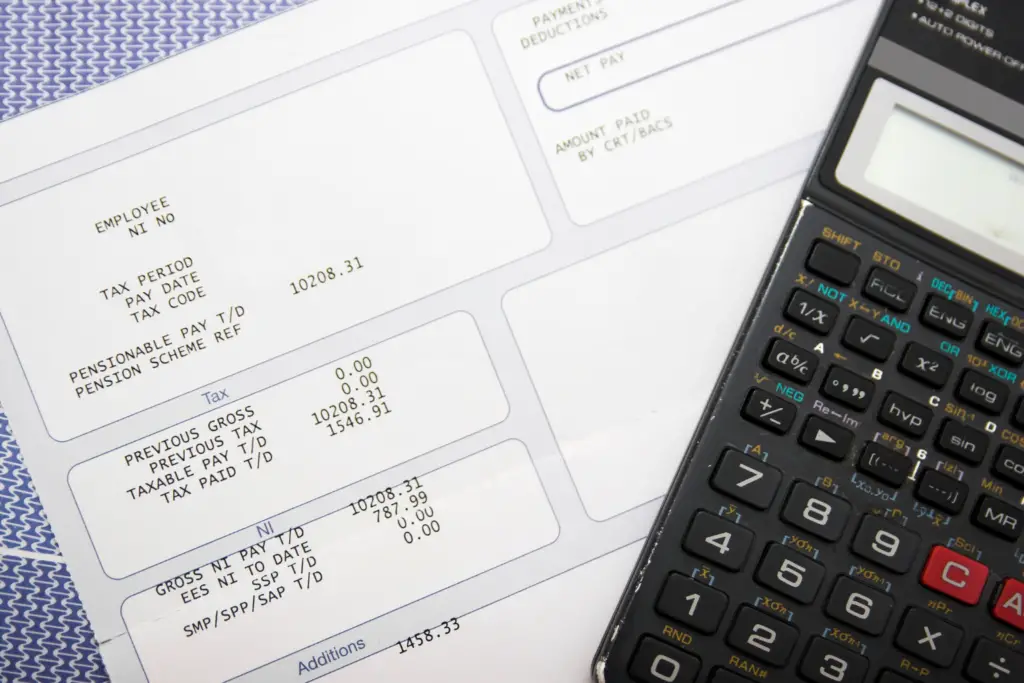

UK Payslip Template

No matter whether you are in the United Kingdom or in India if you have any such organization where the numbers of the employee work and you pay them the salary then you will need the payslip.

It is mandatory as the payment of proof and also for taxation purposes. The template has been designed keeping the standard of the United Kingdom into consideration.

Editable Payslip Template South Africa

If you are operating any kinds of business or other organization in South Africa, where the numbers of the employee work under you then you will need to pay them the salary using the payslip.

It is mandatory for every organization to issues its employees with the payslip from the government of South Africa. Keeping it in our consideration we are attaching the editable payslip template to serve your such purpose, and as the template is editable thus you can easily make changes in it.

Main Sections of Payslip

A salary statement is generated every month by the employer. It’s easy to download in pdf formats. But the fact is that most people aren’t well-aware of the salary slip format and its main components. They pay importance to salary slips when applying for a credit card or a loan in most cases. Most people feel torpid to understand and solve the confusing figures and terms printed in a salary slip.

But the fact is you should emphasize apprehending a salary slip format. Why?

- It can aid you in selecting from competitive offers smartly when you are planning to switch jobs.

- You can entirely use the deductions present in the salary slip to enhance tax liability.

So let’s decipher the essential components of US Payslip, also known as pay stubs.

A pay stub consists of the details that go into the payout calculations of an employee. It includes deductions and allowances made on the gross pay sum. The pay stubs have every detail of the amount an employer pays an employee every month with an entire breakup of the several deductions, employer-paid taxes, and others.

However, note that the net pay on the salary slip for an employee’s gross pay amount in the same company will vary depending on counties, states, cities, and exemptions where the employee works. And the reason is that there is no high state tax, less state tax, or no state tax in some states.

Regardless, the Gross Pay of an employee is always high, and the Net Pay is less due to tax deductions and other benefits.

Different Sections/Deductions in US Payslip or Pay Stubs

Here are the different sections/deductions in the US payslip, or as they call it, pay stubs. This will further enhance your understanding of how deductions and payslip stuff work.

Employee-paid Taxes

Taxes generally consist of the essential deductions on an employee’s gross pay. The various taxes include Social Security and Medicare taxes (FICA tax), federal income tax, and local income tax. In addition, employees are also levied state income tax, state unemployment tax (applicable in particular states), and many other taxes specific to the locality or state where they work.

Every amount deducted from the gross pay under all taxes is clearly exhibited in pay stubs. In addition, they typically display this amount for the payment tenure and the year to date. Interestingly, a pay stub also lists the employee and employer-paid taxes separately.

Employer-paid Taxes

The employer pays taxes on the payroll, and the payroll stub shows it with the current year’s total amount to date and the pay period sum. However, the list of the payroll taxes that an organization pays includes –

- State unemployment taxes (SUTA)

- Federal unemployment taxes (FUTA)

- FICA tax of employer’s portion

- State-specific employer taxes (if any).

Contributions of The Employer

The employers in some organizations make payments to particular heads. A pay stub lists these contributions; however, this amount isn’t deducted from an employee’s gross pay. Nonetheless, the common heads that an employer contributes to include –

- Health saving accounts (HAS)

- Health insurance premiums

- 401(k) plans

- Retirement plans.

Your pay stub will list all these employer-paid amounts along with the current year total to date and the current amount.

Other Deductions

Certain deductions are made on an employee’s gross pay other than taxes that usually vary depending on the company. For example, some employees deduct a certain amount to repay loans, while others contribute to insurance or retirement plans.

The pay stubs may also exhibit the deductions made by the employee to charities or any voluntary or involuntary donations. Your payslip will have a separate line to list these deductions for the current year to date and the payment tenure.

Net pay

The Net Pay is the amount that an employee receives every month and takes home. This amount is calculated after deducting all the required amount from the gross pay.

Moreover, the net pay can even consist of non-taxable incomes. You can find the net pay details for the current year’s pay to date and the pay period on the salary slip or the US pay stub.

To wrap up –

Information Found in Payslip or Pay Stub:

- Employer details, Pay Period, Pay Date & more

- The amount paid for the pay period and year to date. It usually starts from 1st January to the payslip date.

- Gross and Net salary.

- The amount contributed to benefits such as Group Term Life Insurance, 401k, Vision Insurance, and Health Insurance.

- Taxes that are paid to Counties, Cities, and the State Government.

- The mandatory taxes such as Social Security Tax, Medicare Tax, and Federal Income Tax that are paid to government organizations.

However, some states set out the details that the pay stub must include.

FAQs

What is a Payslip?

A payslip or salary slip is a piece of paper that delineates the amount of salary an employee gets in hand, along with all allowances, incentives the company offers, and many other details. The employer gives this paper to an employee at the end of every month.

Who issues the Payslip?

Your employer is liable for giving you a copy of your salary slip each month as proof of salary paid to you as an employee. You can get it from your company’s Finance, Administration, or Human Resource department can issue a payslip or salary slip.

Why do you need a Payslip?

A Payslip or Pay stub is valuable for both the employee and the employer. It is a testament to an employee’s salary from the employer (the company or organization). Moreover, a pay stub gives a complete overview of all the deductions for which they are made from their gross pay sum.

This allows the employees to check and verify if the payroll calculations and the take-home pay amount are correct. Eventually, the verification prevents future misunderstandings or issues with the authorities, contractors, and employees. So with a pay stub, the employer can maintain transparency in the payout calculations with the contractors or employees.

Suppose an employee turns up with any confusion or disputes in the payroll. In that case, the employer can resolve it using the details on the Payslip. Paycheck stubs also help the employer fill out Form W-2 for all employees. Further, it serves as an essential document when applying for a mortgage, loan, or credit card. Finally, the Payslip is also necessary when employees look to switch jobs.

Are Payslips confidential?

No written clause or rules restrict employees from disclosing or sharing their payslips. However, it’s entirely your choice if you want to share or not. But you are supposed to provide the salary slip of your current company to your new employer if they ask for it. This helps to verify your salary.