A receipt book is a must for any business.

The crisp pages of the book of receipts are designed to hold all your customer’s purchases in order and make it easy for you to calculate what they owe. It’s an important document that can be used to record receipts, invoices, and other financial transactions. Keeping your records up-to-date will simplify tax time and make preparing monthly or quarterly reports easier.

The book is simple enough that anyone can start using it right away. But with a little care, you can make sure your receipts never get mixed up or lost! And this guide will show you how to fill out a receipt book. So keep reading it.

Filling A Receipt Book

You’ll need to know a few things before you start filling out your receipt book.

The date

Always write the date at the top of the page. This will help you keep track of when each receipt was issued.

Write The Name Of The Company & Contact Info

Receipts must show the business’s name, along with full contact information. Having this will help you track your sales and monitor your cash flow more accurately. And these details should be easy to include on each receipt, as most receipt books come with pre-printed fields for this information.

Name Or Identification Number Of Service or Product

If you are a hairstylist, the name of the service

If you are a plumber, the type of plumbing service

It is also important to include the name or identification receipt number of the service or product. This will help customers easily identify what they are buying and make it easier to talk about their purchase with you!

The customer’s name

Be sure to write down the customer’s name and their contact information (if available). This will help you track who owes you money and make it easy to follow up if there are any problems.

Salesperson

If you use a specific salesperson, include this information on the receipt. This will help track who sold what and allow for easy compensation as needed.

Itemize purchases

As a general rule, it’s best to itemize each purchase so that you can monitor your expenses more closely. This may not be necessary for all businesses, but it’s a good habit to get into.

The total amount

At the bottom of the receipt, be sure to receipt write down the total amount that the customer owes. This will help you keep track of your income and expenses.

Some Additional Tips on Filling out Receipt Book

Even though a receipt book may seem simple enough, there are a few things to keep in mind when filling it out:

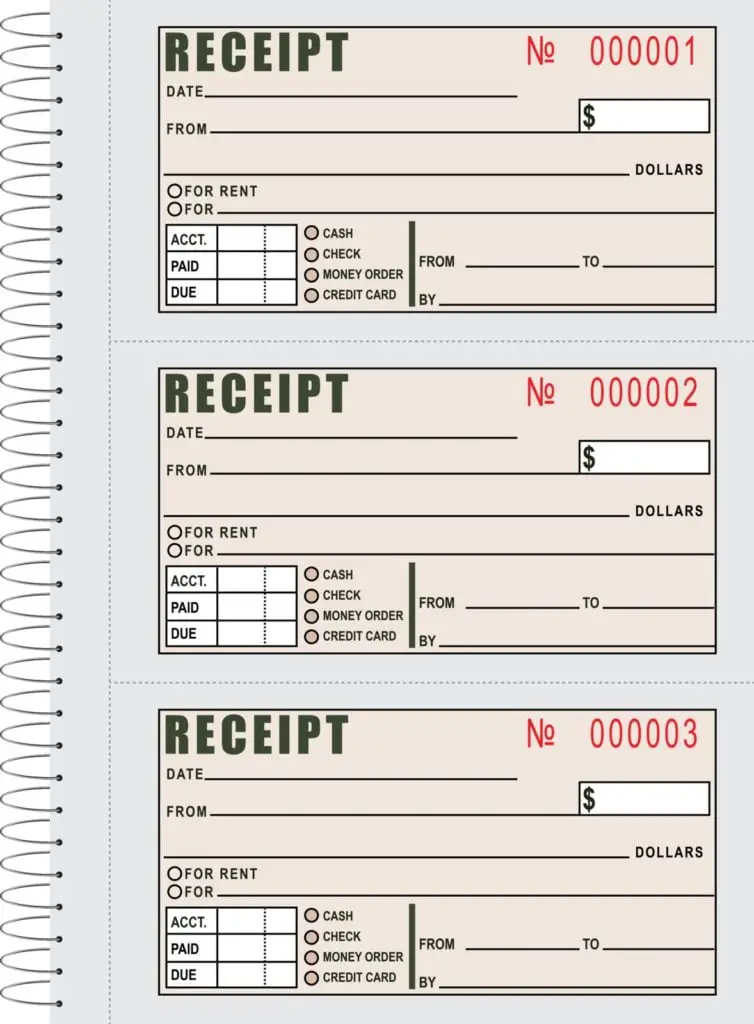

Always Have Two Copies For Each Transaction

One copy of the receipt goes to the customer, while the other should go into your book. This will help you keep track of your income and expenses, especially if you are running a small business. It is also good to staple or clip the receipts together for easy reference.

Use A Separate Receipt Book For Business & Personal Transactions

If you are using your receipt book for both personal and business transactions, it’s best to use two separate books. This will help you keep track of your expenses more accurately and make tax time a little easier.

Use Pen When Filling Receipts

When filling out your receipts, use a black or blue pen. Ensure that your writing is legible and smooth on the original version and the duplicate copy by firmly stamping down each entry. This will also help keep the ink from fading over time.

Do not forget to keep these receipts. They will come in handy if your income and expenses change, later on, so you can adjust your accounting period records as needed.

Include Taxes If Applicable

If you are filling out a receipt for something that is taxable, such as some automotive services or meals at restaurants, be sure to include this information on your receipts.

Receipts always help you keep track of your finances more easily and accurately! If you follow the tips outlined in this guide, you can ensure these important documents are always accurate and easy to read.

Sales Tax Or Any Other Charges

Most of your sales will be taxable if you are running a business. This means that you can include the applicable sales tax percentage nearby information on the receipt so that customers know how much they need to pay. Sellers can also include other charges and their extended price quotes, so there is no confusion about what is being purchased and how much money.

Signed Receipt

If you are selling something that requires a signature (such as some electronic equipment), be sure to include this information on the finished receipt. This will help keep track of your income and prove that the transaction took place.

Frequently Asked Questions

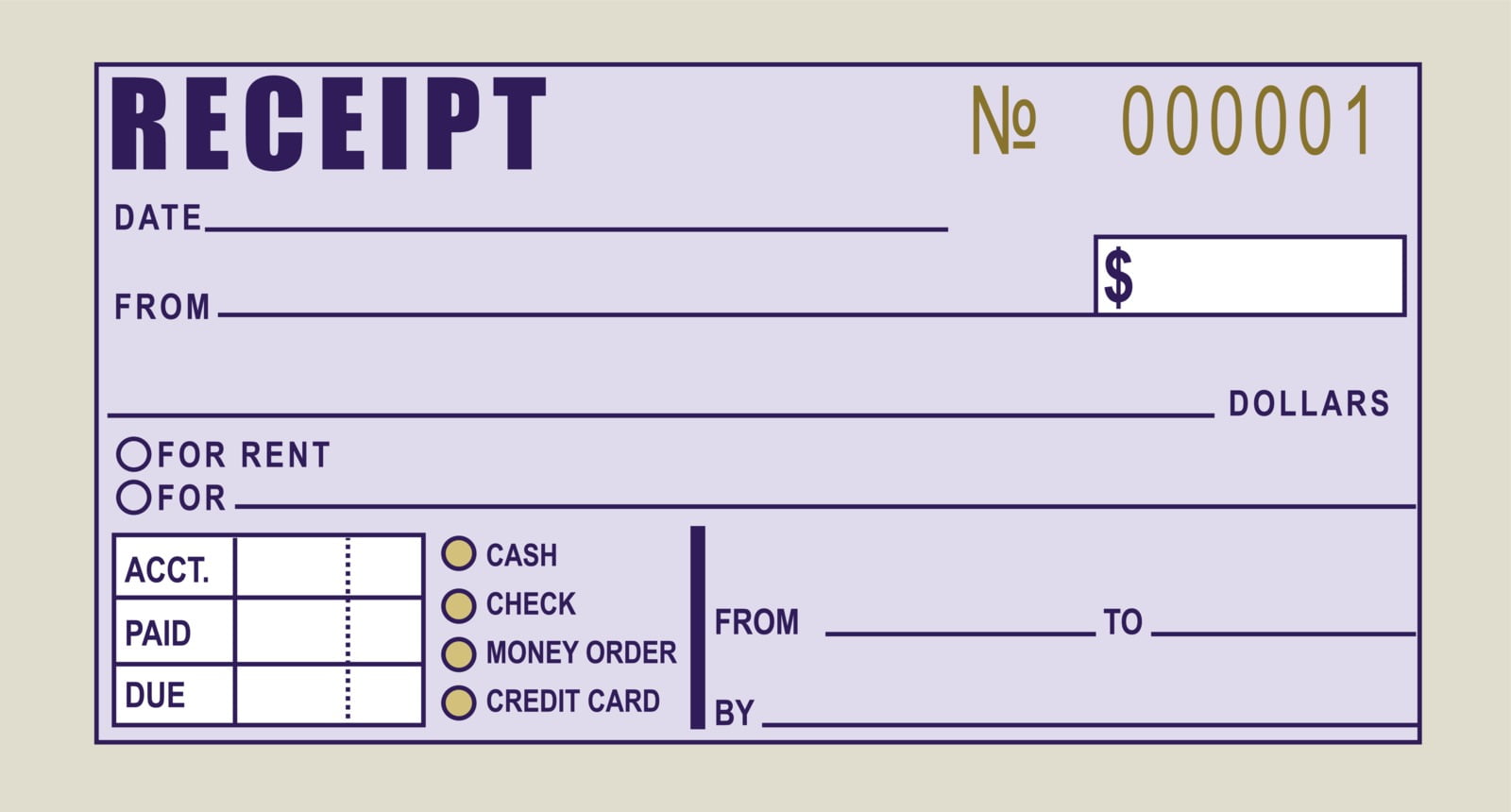

What Is an Example of a Receipt?

You receive the most common type of receipt when purchasing at a store or other business. An electronic cash register usually prints out these receipts, including all of the relevant transaction information.

A written definition of receipt: A record that shows financial records, an itemized list of goods, services rendered by someone, or the amount of money received for a particular purpose.

Is Handwritten Receipt Legal?

The answer to this question depends on the circumstances. If you are operating a small business that is not required to keep detailed records of its transactions, handwritten receipts may be sufficient. However, if you are legally obligated (by the IRS and/or another agency) to keep accurate records of all your expenses and income, then it’s best to use a computer-generated receipt.

How Do You Invoice Self-Employed?

There is no one-size-fits-all answer to this question, as the best way to invoice self-employed people will vary depending on the type of business they are running. However, some tips on doing this might include creating an itemized list of goods or services rendered, adding a note about any applicable taxes, and signing and dating the invoice.

What Is the Difference Between a Receipt and a Bill?

A receipt is usually considered a shorter, less formal document than a bill. It typically contains less information than a bill, and it is usually used for more minor transactions. A bill, on the other hand, is often longer and more detailed, and it is typically used for more significant transactions (like the purchase of a car or home).

Conclusion

An official receipt shows that you have purchased or sold something.

Make sure that you use your legible, neat handwriting in order to keep the ink in these receipts from fading over time.

Do not forget to keep this receipt in case of future expenses and income changes in order so that you can adjust your accounting records as needed.